RentHelper

Helping owners and renters live better together.

Our payment plans can prevent eviction.

Many households live paycheck to paycheck. Few can pay rent in full on the first.

Why not break up rent payments timed with the renter’s income?

Six payment plan types

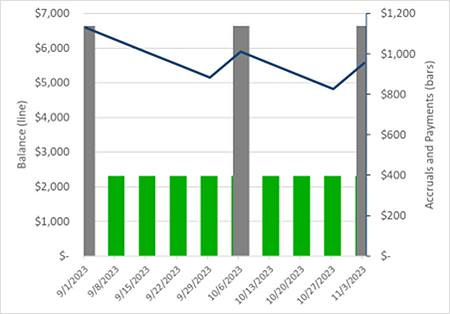

We can match debits to any income schedule. Examples include “Monthly on the first Friday” or “biweekly on Wednesdays.” We automatically adjust debit dates for weekends and holidays.

Weekly

Example: “Weekly on Fridays.”

Biweekly

Example: “Every other Friday.”

Semimonthly

Example: “Each month on the 4th and 18th.”

Monthly on the first weekday

Example: “Each month on the first Friday.”

Monthly

Example: “Each month on the 5th.”

Ad Hoc

Example: “Take $500 now and the rest next Thursday.”

Minimum payments stabilize renters and landlords

Renters cannot choose to enter a payment plan that would have them fall further behind. All plans have a required minimum payment that holds the balance steady. Renters can choose to pay extra and work down a balance over time.

Repayment of a large rent debt seems impossible, but it is possible with our system.

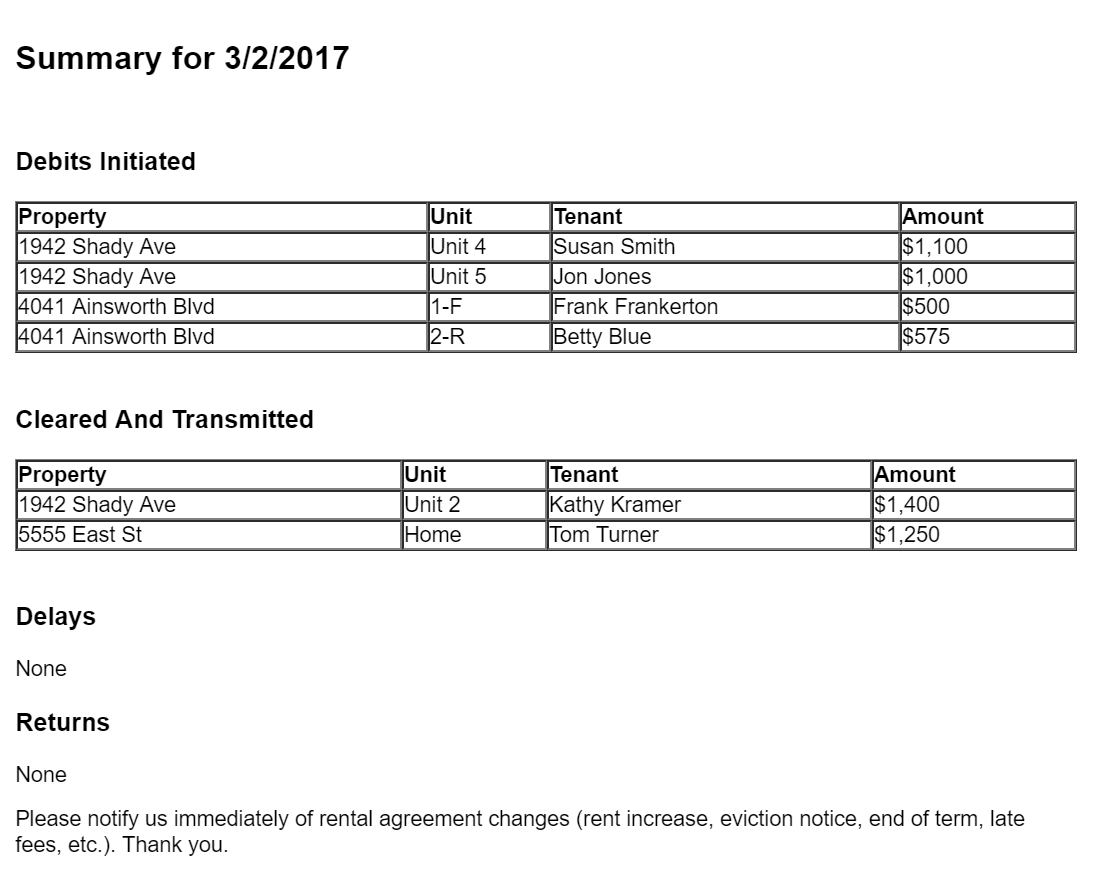

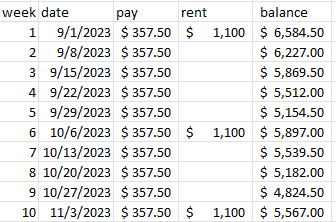

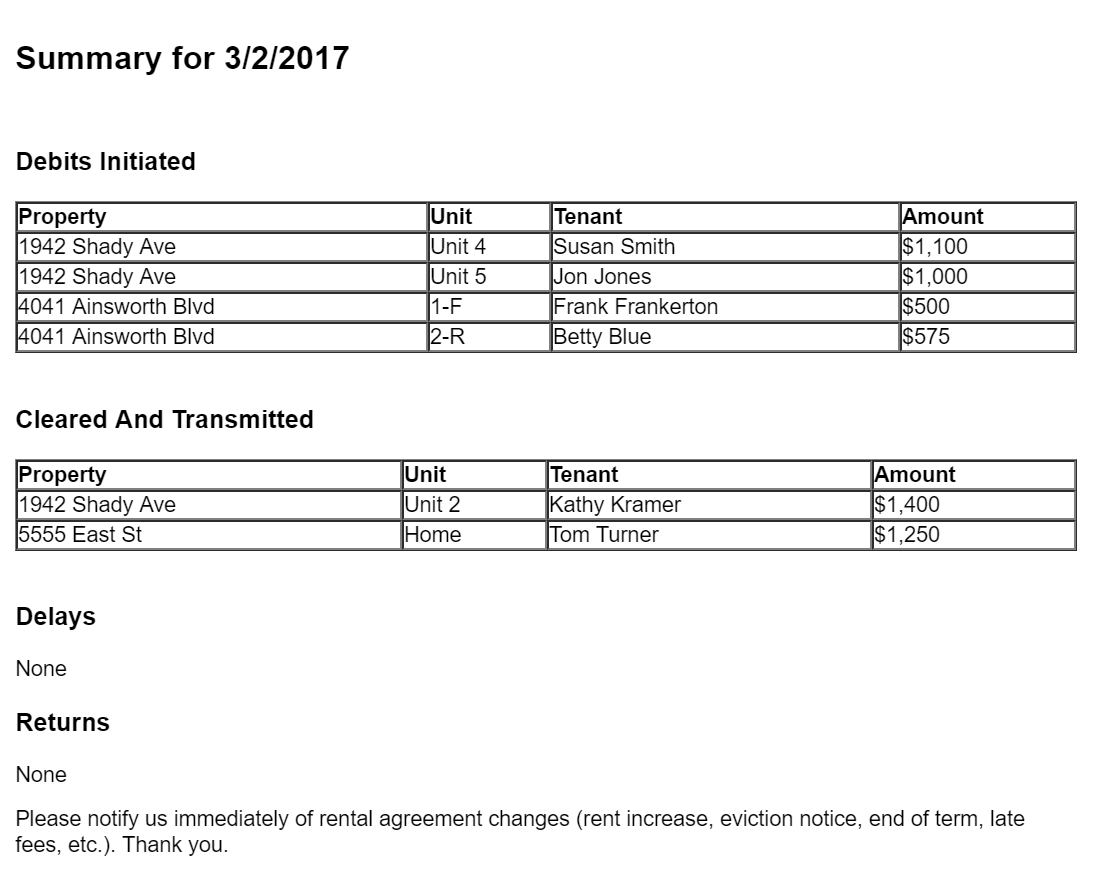

We forecast when the balance will reach zero again

We are the light at the end of the tunnel. Our payment plans calculate all accruals and payments to determine when the balance will reach zero again. This helps both renters and landlords know what to expect.

In this chart, green represents small weekly payments of $357. Gray represents ongoing accrual of $1,100 rent due on the first. The blue line shows the balance going down over time. Suddenly this renter is on track!

We Schedule Out

When a renter knows in advance that their income schedule will be changing, we can schedule a change to the payment plan. Payment plans are automatically updated when the rent changes.

Skip logic prevents paying too far in advance

Some months have five weeks or three biweekly payments. We take care to prevent a renter paying too much in advance. We will automatically skip a payment if a renter is ahead.

Landlords and Renters keep in touch

Renters are texted when rent changes. The payment plan must change to match. Landlords are emailed when a renter enters a payment plan change.

Can be made Court Enforceable

If you take a renter to court or are already in eviction, notify us and we will set the “use and occupancy only” flag. This makes it clear the payment plan is not a new tenancy.

If you take the payment plan to court mediation, you can get an agreement for judgment. RentHelper’s payment plan would then become legally enforceable. Always consult with an attorney.

Enforceable by Credit Reporting

RentHelper payment plans generally count for good credit. We report progress monthly. If a renter ghosts the landlord (stops communicating) or fails to make a good faith effort to pay rent, that will be reported for bad credit.

RentHelper was a huge help! My credit score increased significantly.

Stephen G. (renter)

I can’t believe you got it all.

Cinda H. (landlord)

Rent payment plans cost a fraction of eviction

A $2,000 per month apartment paid weekly will cost the landlord $3 per week.

Compare this to court eviction. In 2021, the average Massachusetts eviction judgment was $7,645. This is mostly court fees, attorney fees and unpaid rent.

Backed up by science

We have over a thousand tenant years of data.

Less vacancy

Tenancies where a payment plan has been used last on average 50% longer.

More certainty

We run statistical analyses on our methods. We are 99.5% confident payment plans produce longer tenancies.

More stability

When landlords get paid and renters get to stay, everyone wins.

Yes, included with the basic service fee!

Unlimited payment plans are included with the RentHelper base fee. RentHelper charges the landlord $6 per thousand collected (0.6%). Nothing collected? No charge. RentHelper is always free for the renter. (If a renter fails to notify us their balance is inadequate for a debit, there may be a bank-assessed overdraft fee.) There is no extra charge for payment plans. There is no per-transaction cost.

MassLandlords members get a free trial for the first renter.

For members of