RentHelper

Helping owners and renters live better together.

Managers

We’re your new star team member.

Rent collection, admin and communication for one-fifth the cost of credit cards.

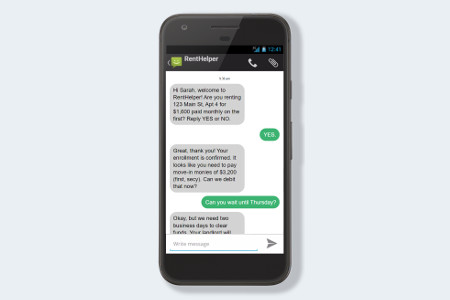

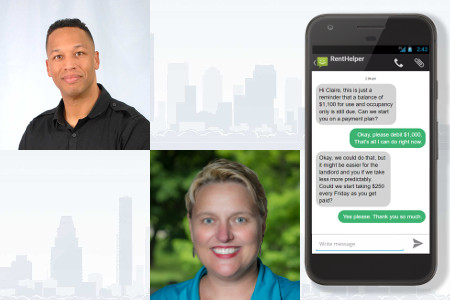

We text with renters to schedule payment.

By default, we debit. Rent is direct-deposited to owner accounts.

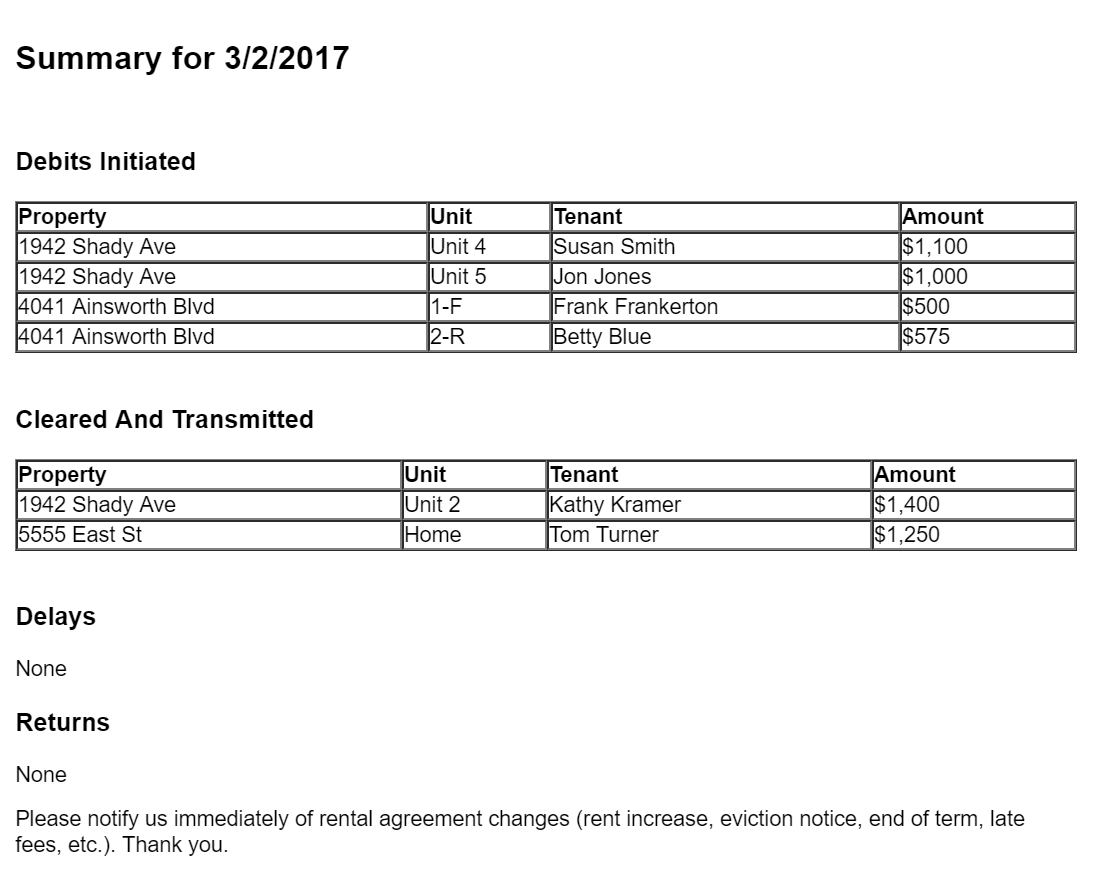

View reports and texts for all owners online or in a daily email summary.

Never Bounces

If a payment fails, we absorb the cost.

Avoid late payment and eviction

Positive and appreciative, collection schedule adjusted to meet both sides’ needs.

Reported to TransUnion for Credit

Most renters will build credit; late payers will have additional incentive.

For members of

Payment Timeline

Timeline represents banking days.

3 Days Before

RentHelper sends an early reminder and invites early payment.

1 Day Before

RentHelper sends a final reminder and invites early payment.

Rent is due

Renters have until 10am to text WAIT and reschedule. Otherwise, funds are debited by close of business.

2 Days After

Verified funds are transferred to owner accounts

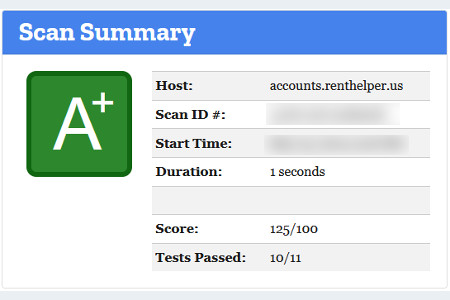

RentHelper uses fastest-possible same-day ACH for all transactions. No other service verifies funds faster.

We are BSA/AML compliant.

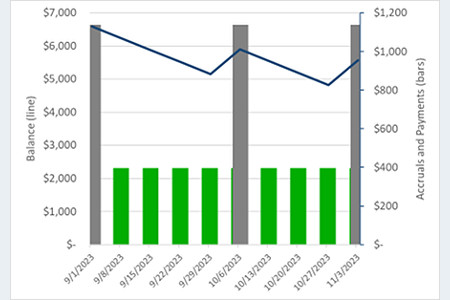

A Proven Track Record

As of February 2026: RentHelper has collected over $21 million in rent. We’ve sent and received over 70,000 messages. Renters who have ever used a payment plan have been stable over 3 years on average and counting.

Interactive

Renters can say anything and we will understand it: “Pay on Tuesday,” “I got a new phone number,” “I switched banks,” etc.

Intensive

On average we exchange 3 texts a month per renter. Some renters text 20 times or more.

Freeing

Managers who have used our service cannot imagine managing without us. Texts are logged silently for you to review should you ever need to. We will only alert you to delays and other problems.

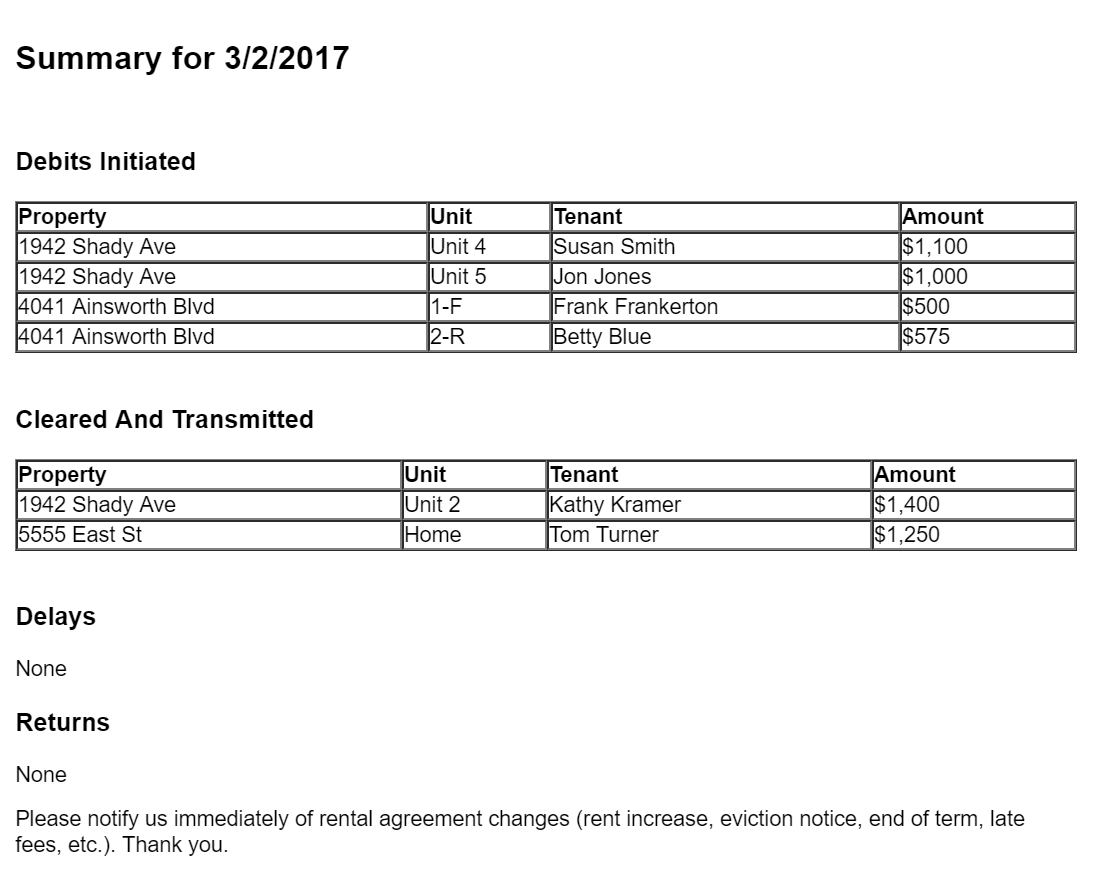

Daily Reports, Easy Reconciliation

We email you a report whenever there’s activity, making it easy to see who is up to date with their rent. Hands-on owners can be copied.

RentHelper works as hard at collecting rent as anyone you would hire for a fraction of the cost.

Tenants Love Us, Too

We have avoided over 90% of all renter overdraft fees. (The 10% we didn’t avoid, the renter did not text us.) With RentHelper, renters save time and expense, remain in control of their accounts, and build credit. Renters no longer need to purchase money orders or visit the office. Renters can stop or reschedule a payment at any time, with owners kept in the loop on all delays. Best of all, payments are reported to TransUnion, which for most renters, will help them build credit. When renters pay financial services less, they pay housing providers more. A stable and successful renter is a stable and successful owner! And you’ll have more time to add value as manager.

Pricing

Other services like credit cards, Venmo and PayPal charge 2 – 3% ($20 to $30 per $1,000).

And they don’t report good and bad credit.

RentHelper costs just 0.6% ($6 for every $1,000 of rent we collect).

No contract.

No minimums.

No monthly fees.

No bounce fees.

No hidden or other fees.

Your currently spend $41 per month to process rent.

Cost of RentHelper: $36 per month.

RentHelper will save you $9 per month.

Number of Units

Time you or your staff spends chasing, receiving, and depositing rent

minutes

Value of your time (or your staff’s)

/hr

Percentage of checks that bounce

%

Average credit card processing fee

%

Average rent

/month

What do we mean when we say, “hedge against eviction?” RentHelper is not an insurance product. If a tenancy is headed for nonpayment eviction, our payment plans are genuinely helpful at preventing the eviction. Also, the possibility of a negative credit report is a genuine motivator for any renters where payment plans fail; by offering to withhold a negative report if they move out, lengthy court process is avoided by mutual agreement. Last we checked, our success rate at avoiding a negative credit report was 99.1% of tenancies. The vast majority of these paid as agreed in the end. Your results may vary. But compared to the cost of an eviction, our service gives you options you otherwise wouldn’t have. That’s what we mean.

| Management Features | Included? |

|---|---|

| Automatic rent collections and payments. | |

| Scheduled rent increases, payment plan changes, move-outs and more. | |

| Recorded offline payments by cash, check money order or other method for one accurate ledger. | |

| Refunds when needed. | |

| Utility payments. | |

| Multiple properties. | |

| Multiple states. | |

| Option for different bank accounts for different properties. | |

| Manager can pay the owner's service charge. | |

| Daily activity reports. | |

| Fastest possible clear times. | |

| Unlimited users. |

| Move-in Money Features | Included? |

|---|---|

| Collect first month's rent. | |

| Collect last month's rent. | |

| Collect lock change fee. | |

| Collect pet fee. | |

| Collect and give you the security deposit.* | |

| Refund security deposit. | |

| Apply last month's rent. |

| Mediation and Eviction Prevention Features | Included? |

|---|---|

| Clear and timely text conversations. | |

| Good credit reporting incentive. | |

| Bad credit reporting for nonpayment and ghosting or other non-communication. | |

| Late fees. | |

| Comprehensive payment plans. | |

| Reminders to renters. | |

| Follow-ups to late renters. | |

| Talk to a real person. | |

| Set "Use and occupancy only". | |

| Works with renters who can't text. | |

| Works with renters who don't have a computer. |

| Accounting Features | Included? |

|---|---|

| End-of-year 1099-MISC. | |

| Invoices to deduct our service charge as an ordinary and necessary business expense. | |

| Multiple LLCs, Incs and tax IDs. | |

| Customizable bank statement descriptions. | |

| Rent arrives in the amount paid for easy statement matching. | |

| Works with Section 8. | |

| Works with roommates. | |

| Works with parents or guardians paying for someone else. |

For members of

FAQ

How does RentHelper compare to property management software like Apartments.com RentCafé, Buildium, or Appfolio?

We can be an add-on to existing management software, or we can be a standalone “management software lite.”

Note that we are designed to coexist with existing management software packages, not compete. Management software is the jack-of-all trades, focusing on listing, leasing, maintenance, and more. They don’t focus on payments, which are the major reason tenancies fail. Management software typically requires renters to log in to do anything, exposes you to the insufficient funds process (NSF) other banking issues, and requires you to respond to all payment problems.

RentHelper on the other hand was custom designed to specialize in payments for owners and managers with or without management software. Because we perform a full “know your customer” or KYC process, renters can perform many actions over SMS, including controlling payment amount and timing. We insulate you from the complexity of the banking world and various return codes. And most importantly, if a renter is short, we ourselves intervene to follow up, offer payment plans, and deal with other admin. You only need to get involved if the renter stops communicating and/or the tenancy is being terminated. We’re particularly good with subsidized and down-market rentals, where renter relationships can be low-tech and high-touch.

RentHelper transactions are transmitted into bank accounts with renter name, unit, and exact amount paid, making it easy for most management software to automatically match bank statement entries with renter invoices and properties.

How does RentHelper collect the fee?

We do not deduct it from your rent. Each tenant payment appears in your account in exactly the amount they paid. The aggregate service charge is calculated and auto-debited on the last business day of the month. You will receive an invoice for your records.

My tenant doesn’t have a bank account.

Unbanked tenants can still use RentHelper with debitable cash cards that they can purchase and load at various locations. For example, a renter can go to a convenience store and purchase a Netspend or GreenDot. They will call a number on the card to activate it. They will request their ACH and Routing number, and put that information on our renter enrollment form. To pay rent, they need to load that card at any convenience store that loads cash cards. This works even if they are banned from opening new checking accounts due to prior bad banking experience. Contact us and we’ll walk your renters through the process.

My tenant can’t sign up online.

That’s fine, tenants can sign up on paper. They need to fill out our renter enrollment form, place their ID on the paper in the box provided, and upload a picture of the form to renthelper.us/enroll. (Forms available for download there, as well.) If they cannot take a picture of the form, we can receive the form and a library photocopy of their license by US mail. If they will be temporarily without text message, we can manage that process with email.

I’m evicting my tenant and want to refuse partial payments in order not to establish a new tenancy.

No problem, we can refuse payments. Alternatively, we can send text messages with legally required wording (e.g., “for use and occupancy only”). Fun fact: RentHelper routinely avoids evictions by moving tenants from monthly payments to pay schedules tied to their income for use and occupancy only. Mediated agreements are usually fulfilled without eviction. Similar success with your tenants is not guaranteed, but we’ll try.

What if sometimes the tenant still pays with money order or cash?

Not a problem, just let us know. If you collect the rent, your RentHelper fee for that unit that month is zero (of course), and we will include that payment in their credit history for free.

Can I use RentHelper if my tenants are just roommates?

Yes.

If the tenants agree on a rent split, they can each fill out a separate authorization for their share of the rent.

If the tenants typically pay each other, and then one tenant issues a single check to you, we would recommend they decide on a consistent split and fill out a separate RentHelper enrollment each for their share.

RentHelper does not replace the terms of a rental agreement. If you have a rental agreement that specifies roommates will have “joint and several liability,” you will still be able to enforce non-payment of one against all tenants. When in doubt, consult with an attorney.

In which states does RentHelper work?

Owners/managers must have a US address and must be collecting rent from a property located in the US (all states, districts, and territories).

What if my renter doesn’t respond to your texts?

The default is that we will debit their account.

Can I pass the costs onto my renters?

Yes, by raising the rent.

We designed RentHelper’s fees to be deducted separately from any transacted rent amount. In other words, what you see in your bank is exactly the rent collected. This makes reconciliation easier. This also makes records brought into court more understandable to court staff and judges. Some states do not allow regular monthly fees over and above base rent (e.g., Massachusetts General Laws Chapter 186 Section 15B does not allow collection of anything “in excess of the current month’s rent”). Finally, we are able to keep our costs down by transacting one fee per landlord per month, rather than one fee per renter transaction. Best practice is to treat the cost of payment processing as a cost of doing business, or to raise the rent if this is not supportable.

How are changes in the rent amount handled?

If the amount to be debited increases (e.g., rent increase), we require an SMS amendment to the authorization. We text the renter to ask if we can debit the higher amount. The renter just needs to text us back “yes” or “okay” etc.

If the amount to be debited is lower than what a renter authorized (e.g., their housing assistance payment increases, such that their share decreases), then all you have to do is tell us and we will notify the renter via sms. ACH authorizations are valid for any lower amount.

In the event we need confirmation but we don’t get a timely SMS reply from the renter, we notify you and attempt email follow-up ourselves. Usually what has happens is someone’s phone number has changed and they haven’t notified us.

Rarely a renter will initiate a rent amount change. If rent is decreasing, we first get your approval.